By Maureen Busch, VP, Compliance and CRA Officer

COVID-19 has dominated 2020, no doubt. However, natural disasters have not taken the year off. Quite the contrary. We have seen wildfires in California, an inland hurricane in Iowa, and most recently a near-category 5 hurricane bringing devastation to Louisiana, Texas and Arkansas.

Like the rest of the Gulf Coast, here in the Tampa Bay area, our greatest risk from a natural disaster is from a hurricane. We Floridians are no stranger to hurricane preparedness—trimming trees, securing patio furniture and other objects that could become airborne, stocking up on water, batteries, etc. But, what about financial preparedness in a time of emergency? Should a disaster strike, how prepared will you be?

The Consumer Financial Protection Bureau (CFPB) has numerous resources on its website to help you prepare for a disaster before it happens, as well as steps to take after a disaster. Additionally, below are three steps you can proactively take, before a natural disaster occurs, to ensure you have a plan and that you’re financially prepared.

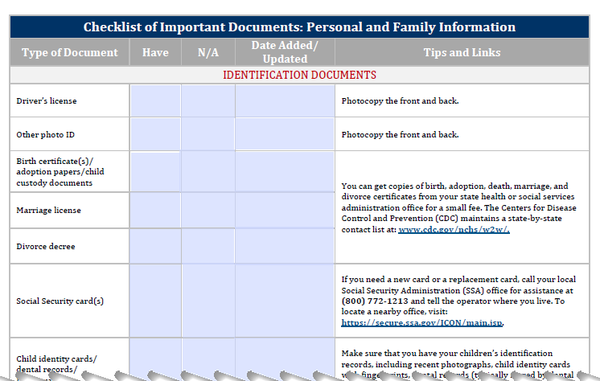

1. Document your financial and other important information. Trying to locate this information post-disaster may be time-consuming, difficult and stressful. FEMA has developed a resource to help you document your finances, including everything from bank account information to proof of pet ownership, which can be accessed here.

A word of caution, the document was created to help you strengthen your financial preparedness for disasters and emergencies. However, you need to properly safeguard it, as once it’s complete, your sensitive financial and medical information is now neatly organized in one document, a goldmine for an identity thief. Consider storing original copies of important documents in a plastic bag in a safe deposit box. While contents are not insured, the boxes themselves are fire and water resistant.

Example of checklist included in FEMA’s Financial First Aid Kit:

2. Examine your insurance policies and ensure you’re covered for disasters that could occur in your region. For example, in the Tampa Bay area, even if you do not live in a special flood hazard area, you may consider obtaining flood insurance, as homeowners policies do not cover damage suffered from a flood.

3. Build an emergency fund. A good strategy is to set aside money in an emergency savings fund. The amount you save in the fund depends on your situation. To determine the right amount for you, think about the most common kind of unexpected expenses you’ve had in the past and how much they cost. This may help you set a goal for how much you want to have set aside. If you do not have excess cash, the CFPB also has tools through its Start Small, Save Up initiative to help consumers establish and grow their savings.

The CFPB provides many other disaster/emergency related resources on its website, such as how to prevent fraud after a natural disaster and a guide to working with contractors after a natural disaster.

One of the best documents the CFPB has compiled is a listing of 9 financial issues you might face after a natural disaster. The list, which includes not only the issues you may face, but tips on how to handle each situation, is based on what it learned from consumers after past natural disasters.

About the Author:

Maureen Busch serves as Vice President, Compliance and CRA Officer at The Bank of Tampa. Additionally, she serves on the CFPB’s Community Bank Advisory Council, where Director Kathleen Kraninger and Bureau staff keep the council abreast of educational resources available and financial literacy initiatives. The CFPB is passionate about encouraging consumers to create, maintain and grow savings accounts as part of their overall financial well-being.

This article originally appeared on The Bank of Tampa’s website. To read more about The Bank of Tampa, visit: thebankoftampa.com/news