By Stacey Pittman, Managing Director, BT Wealth Advisors

As we proceed through 2020—a year that brought us some unexpected (and unwelcomed) surprises! Not only have we faced a global health crisis, but for many of us, we have faced the unfortunate financial side effects of the pandemic. For some, it has meant a job loss or loss of income, while for others, it has meant increased volatility in investments and retirement portfolios.

I think everyone can agree that 2020 has brought an element of fear—fear of the unknown and fear of uncertainty. When so much is uncertain, it is human nature to search for those things that we can control.

When speaking with clients about retirement planning, I talk a lot about the idea of control. Specifically, the fact that there are quite a few things that they have absolutely no control over, such as future market returns and government policy on subjects like taxes or Social Security. There are other things they have some control over, such as how long they choose to work, and to some degree, what their earnings are over time. However, the single most important issue they have total control over is whether or not they put a financial plan in place.

At BT Wealth Advisors, we encourage all of our clients to work with their dedicated financial advisor to create a comprehensive financial plan. The goal of the financial planning process is for the advisor to understand a client’s goals and priorities in life, and to craft a pathway to achieve them. Financial plans help guide and direct a client’s actions to achieve desired outcomes.

There are many components of a financial plan, with a comprehensive plan covering everything from retirement planning (how much do I need to fund my retirement) to tax planning (how do I grow, invest and eventually distribute my wealth in the most tax efficient manner possible) to insurance planning (how do I adequately protect myself, my family and our assets) to charitable planning (how can I optimize my charitable giving) to estate planning (how will my wealth be distributed upon my passing). Understandably, this can be a time-consuming process. Therefore, some clients choose to start with just one topic (such as retirement planning) before moving on to other topics at a future date.

The beauty of the financial planning process is it is just that—a process. A plan will change and evolve over time, and therefore, it should be revisited every year to ensure that any life changes are incorporated. It can be also help clients make major decisions—such as the purchase of a new home or an investment property or even the decision on when to claim Social Security. Revisiting the plan every year also helps measure the progress they have made over the past year towards their goal.

Most importantly, the financial planning process provides clients with confidence. By following long-term plans that are set in place with specific goals in mind, we can preserve your investment strategy. Uncertainty in the market can be influential over short periods of time so we filter this by focusing on long-term goals, which result from financial planning. Those who focus on the long term may be less concerned if the market goes down X% over the next few months because they are looking far beyond that. This is one reason why we implore you to take the longer view—it is better for your psyche and encourages more thoughtful and deliberate financial decisions.

Are you interested in partnering with BT Wealth Advisors to take the long view by focusing on financial planning for the long term? Please contact me or a member of my team by calling (813) 998-2791 or emailing me at spittman@btwealthadvisors.com.

This article originally appeared on The Bank of Tampa’s website. To read more about BT Wealth Advisors, please visit our website: www.thebankoftampa.com/wealth

The opinions expressed in this material do not necessarily reflect the views of LPL Financial.

Disclosures

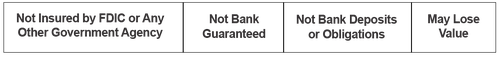

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. The Bank of Tampa and BT Wealth Advisors are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using BT Wealth Advisors, and are also employees of The Bank of Tampa. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, The Bank of Tampa or BT Wealth Advisors. Securities and insurance offered through LPL or its affiliates are: